👋🏽 Welcome to Witty Wealth’s The Daily Wit. We get to the point on what you need to know for your tech stock investing journey.

If you’re enjoying this but you’re not subscribed, sign up and join 1152 friends who have their wits 👇🏽

Does your brain ever feel fried?

Mine does most days. The internet’s information fire hose is constantly pointed at my face. Twitter. Email. Instagram. Reddit. Facebook. Twitter again.

I feel this the most when following the stock market. There’s too much to process.

The purpose of The Daily Wit is to keep you informed on tech stocks yet avoid the intel flood.

On Monday’s, I want to help us get ahead. Here’s what to expect this week:

Quarantine and Chill

The main tech stock event this week is Netflix’s earnings call on Thursday. While these calls are no Tiger King, this one can be just as exciting.

Why?

Big price swings can happen based on this call. Stock forecasts are based on assumptions. Results revealed in the call have a chance to be way off than initial projections.

Why?

With many companies stopping earnings forecasts due to the pandemic, Netflix management decided to give it a shot. In their Q1 shareholder letter, they wrote:

“Our internal forecast and guidance is for 7.5 million global paid net additions in Q2. Given the uncertainty on home confinement timing, this is mostly guesswork. The actual Q2 numbers could end up well below or well above that…”

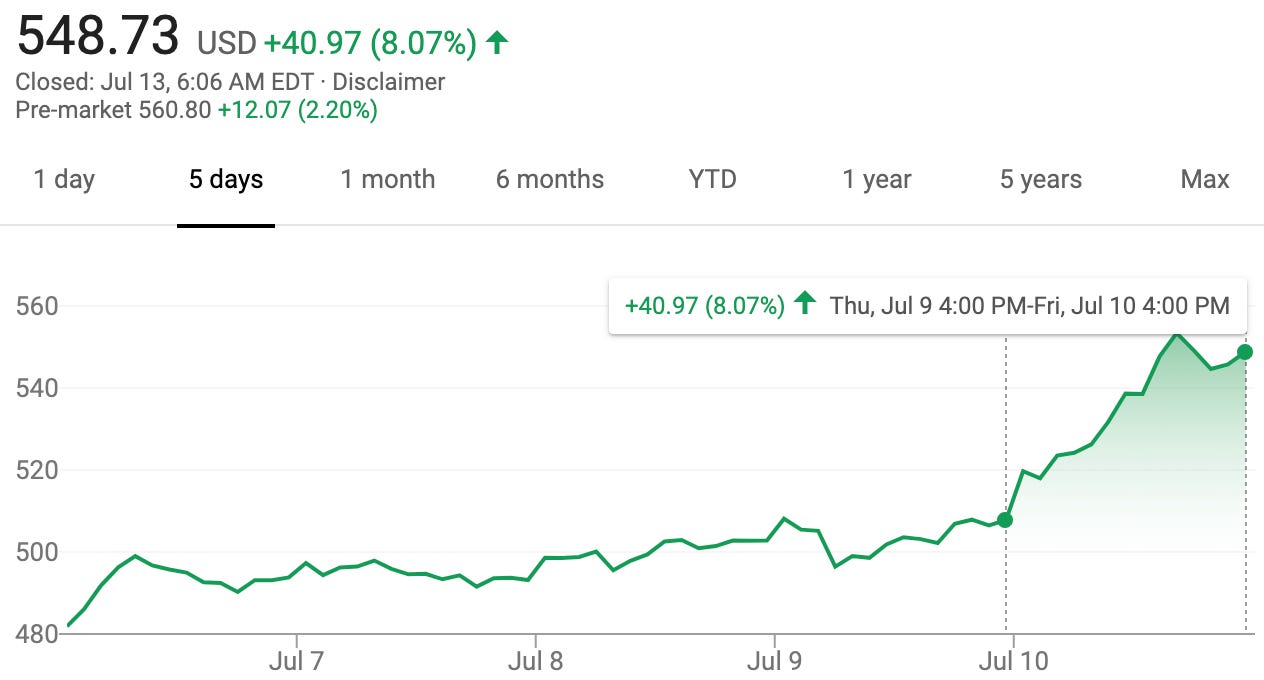

Wall Street is bullish the 7.5M number will be beat. On Friday, Netflix’s stock surged over 8% after an analyst call on this subscriber growth.

Goldman Sachs predicts a killer quarter:

“We believe Netflix could add at least 12.5 million total net paid subscribers in 2Q, primarily driven by accelerating EMEA [Europe, Middle East and Africa] and APAC [Asia-Pacific] penetration and strong growth in the U.S. and LatAm.”

For context, Netflix added 16 million subscribers in Q1.

Two other tidbits to watch:

How much will Netflix gain from a depreciating dollar? Netflix has been growing internationally and doesn’t adjust for currency risk. When the US dollar depreciates, like it has done recently against other major currencies, Netflix’s revenue numbers should benefit

How long can Netflix survive without producing content? Netflix is now known for producing shows (like Stranger Things), rather than licensing shows (like The Office). With production suspended due to COVID, how will Netflix adjust? Does it need to?

Two discreet IPOs

Two tech companies are expected to IPO on Wednesday. There's limited commentary on them so far. Here’s what we know:

First is nCino, a software company that helps banks onboard and serve their customers efficiently. Think account opening, onboarding, and loans. While not yet profitable, bulls are excited about nCino’s strong revenue growth and path to profitability.

Second is GoHealth, an online service that lets users compare health insurance quotes and buy coverage online. They excel in Medicare Advantage, accounting for ~10% of enrollments. Bulls are excited about GoHealth’s sharply growing revenue. Bears believe the space is crowded and GoHealth makes low margins (~1%).

Chamath’s short bet

Chamath proposed a long term bet against Facebook (FB) and Google. Remember, he was one of the five executives that ran FB before IPO.

TL;DR

No more buying way to relevancy. The internal mindset at these companies is about maintaining, not innovating. Before they could buy what users are entertained by (YouTube, Instagram, WhatsApp, etc). Now acquisitions take way too long.

Less revenue due to regulation. Governments will seek regulation. FB and Google threaten political power. Regulation leads to less revenue.

Taxes. Governments will tax these companies to make up lost pandemic economic gains. These companies are the easiest target.

Potential break ups. Antitrust cases are rising against these companies. For example, right now Alabama is the only US state not holding an investigation into Google.

We’ll get more of an idea later this month when the CEOs of Amazon, Apple, Facebook, and Google appear in front of Congress.

In case you missed it

Last week I began posting daily. More context here.

I also shared bull and bear cases on Slack 🔮, Zoom 🚀, and Peloton ⏯.

If you loved any of these articles, please forward it to a friend you think will like it too. I appreciate it!

Happy Monday,

Note: This content is for informational purposes only. It should not be relied upon as legal, business, investment, or tax advice. Your use of the information contained here is at your own risk.