👋🏽 Welcome to Witty Wealth. We discuss the most interesting stock market stuff going on.

If you’re enjoying this but you’re not subscribed, sign up and join 1106 friends who have their wits.

It began in a selfish way. I proposed the Witty Transparency Fund (WTF) because I wanted it myself.

Little did I know I wasn’t the only one.

Since presenting WTF last week, I’ve had ~30 in-depth conversations with Witty readers.

We openly discussed each other's investing goals, approaches, and pains. We also touched on our major investing wins, regrets, and wishful thinking. It was like an investing personification of Usher’s mid 2000s radio hit, Confessions part II.

A new product

In short, I learned before focusing on WTF*, we need something else first. A product that helps us understand. A product that helps build confidence.

Introducing ‘The Daily Wit’

Time and again, I heard the same thing. We all try to understand the news in the same way. With each story we ask ourselves:

What's happening?

Why is this happening?

Where are things going?

What stocks does this affect?

How will it affect these stocks?

But existing resources fall short. They leave us wondering:

How would top investors think about this news?

What are the extreme opinions on these stocks?

Why do my eyes glaze over every time I read something?

Why can’t we go a couple levels deeper to understand how things work?

Why can’t we look forward? Why do things only cover what happened?

The Daily Wit is a daily newsletter that helps us on our tech stock investing journey.

By following along, you’ll be informed on what you need to know about tech stocks. That means what these companies are doing, trends they are riding, and differing points of view on their future.

Now you might think, Anuj, don’t these things exist in the internet in some form? Do I really need another newsletter?

Well yes and yes. These things do exist out there. But existing options suck. As mentioned above, they don’t take the view of us, the investor.

To help us feel more confident, I’m going to experiment with the following approach:

I’ll cover topics that we want to know:

Attention-worthy current events (e.g. acquisitions, IPOs, earnings calls, product announcements)

Trends

Differing opinions on the future of these companies (e.g. bull case, bear case)

We’ll learn from the best:

Understand what top investors and experts are saying

Pull sources from the best of the internet (and then soon, our own interviews and analysis)

Explore the important details

I’ll make it light:

Write in the same conversational tone

Focus on only the 2-5+ most interesting stories

Keep stories short and visual (~250 words or less)

What I learned from the chats

The conversations helped get more clarity than ever on the core Witty community. If you care, here’s three things I learned from these conversations:

Investing styles

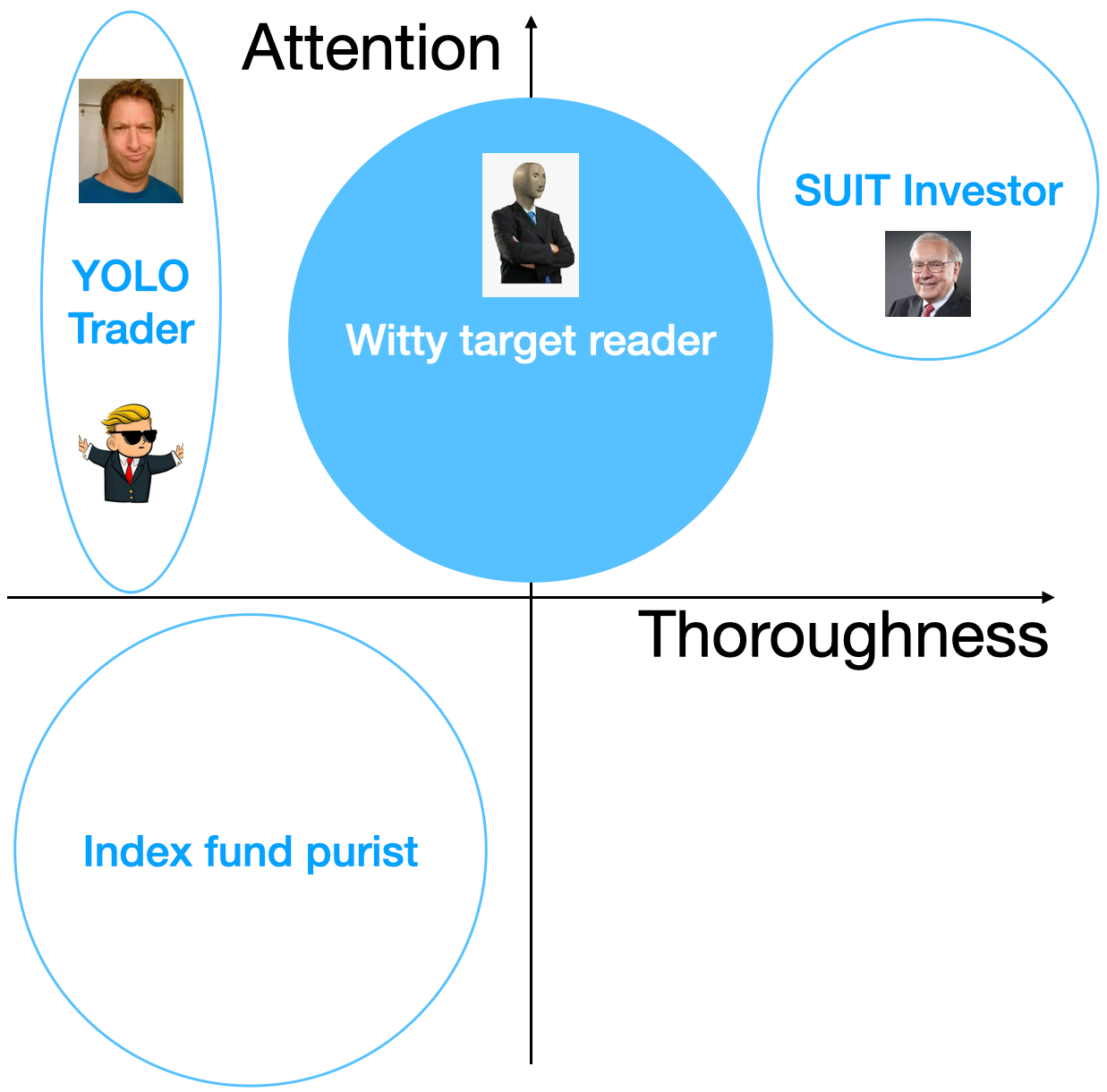

As these discussions unfolded, it became clear that people's investing styles differed in two dimensions.

The first dimension is thoroughness in investing. On the far left is the ‘YOLO’ style - essentially no analysis like r/wallstreetbets or Dave Portnoy. On the far right is opposite (like Robot Warren Buffett). I call it the ‘SUIT’ style - SUper Intense Thinking. Imagine excel models that halt computers, thousand dollar an hour expert interviews, and million dollar data sets.

The most common Witty reader I talked with is somewhere in the middle. Investing isn’t their day job (like SUIT). Yet they like to be informed with what’s going on (unlike YOLO) and adopt analysis they understand.

The second dimension is the ‘level of attention paid’ to the stock market. Towards the bottom is where you’ll find the ‘index fund purists.’ This profile checks stock news at most once a week. Towards the top you have people who live and breathe the stock market - checking in on or thinking about related stuff a couple times a day. As Witty is a stock market newsletter, my target reader lies in the top half.

Here’s a diagram of how I think about these personas against the dimensions:

Goals

With that, I dug into the goals and ambitions of the target reader. Almost unanimously, three investing goals arose:

Understand what is going on

Build confidence in their decision making

Achieve returns better than or equal to the market

While I can’t guarantee the third, The Daily Wit aims to help with the first two goals.

Lonely island is real

Last post I wrote:

Believe it or not, emulating Chamath’s style feels like being on a lonely island.

Popular online communities like r/wallstreetbets are entertaining, yet focus on day trading and options. TV channels like CNBC are boring and focused on gen-x and boomer blue chip stocks.

While that was my own assertion, most people I talked to felt similar.

There’s an unserved burning passion for technology stocks. These readers follow the most inspiring tech and CEOs with reverence! One new friend dug into Tesla and became captivated. After learning the intricacies of Tesla manufacturing, he decided to buy a Model 3.

People believe in these companies. They represent a belief system. Yet for half the readers I talked to, they struggled to find others to share them with. With more readers, we will be able to build a community.

Housekeeping

If I described your persona in the email, I’d love to meet you! Feel free to reply to this email

If you know someone that would benefit from The Daily Wit, please share this with them!

If you don’t want to receive The Daily Wit - I understand. Feel free unsubscribe. Thanks for giving me a shot!

*The Witty Transparency Fund will be an ongoing series within The Daily Wit

See you tomorrow,

Love the idea, but curious why anyone serious (aka not trying to gamble) wouldn't aspire to the top right, rather than the top middle?