👋🏽 Welcome to Witty Wealth’s The Daily Wit. We surface what you need to know for your tech stock investing journey.

If you’re enjoying this but you’re not subscribed, sign up and join 1146 friends who have their wits 👇🏽

I finally gave in.

100 days into quarantine, I noticed how out of shape I was getting. Occasional exercise with friends on Zoom wasn’t cutting it.

Unquestionably, I fired up my browser to onepeloton.com. I’ve heard so much about Peloton’s exercise equipment and fitness subscriptions. What’s the fuss about? 5 minutes and ~$2700 later, my credit card got the first workout.

Sadly all I can do now is sweat out my bill. My indoor bike won’t come for another 6 weeks.

The market has been bullish about Peloton during quarantine. The stock price has more than tripled. As we’ve done throughout this week, here’s the bull case / bear case.

Bull case

Bulls love Peloton for three reasons. They say Peloton:

Is growing the exercise market

Has a great brand

Has a path to profitability

Growing the market

Going to the gym feels like 90% of the battle.

Why not bring the gym to you?

Before Peloton, home fitness solutions focused on providing equipment. Peloton changed the game. They brought home the gym experience: high quality instruction and group fitness dynamics.

This difference helped unleash the market. In Peloton’s S-1, they claim “four out of five Members were not in the market for home fitness equipment prior to purchasing a Peloton Connected Fitness Product.”

Bulls believe Peloton can ‘have its cake’ (by growing the market), and ‘eat it too’ (by having the best product for these new consumers).

Peloton now aims to reach more customers by launching more affordable products. Yesterday their CFO said a lower priced treadmill is in the cards.

Brand

What’s a good way to keep customers? Don’t make something just useful.

Make it a cult.

Peloton did just that. They focus on the intersection of self-improvement and self-love. Apparently a couple folks a week get a Peloton logo tattoo!

What other tech brands have this level of worship?!

This identity helps with Peloton’s 96% one-year retention. As Forbes writes, that's “unheard of in an industry where most people quit their gym memberships by February.”

Path to profitability

Peloton lost $55M in their last reported quarter. Yet bulls believe getting profitable is straightforward: sell more subscriptions.

Peloton generates most of their revenue on equipment and fitness subscriptions.

My favorite source, Ben Thompson, wrote a year ago,

“Peloton spends a lot on marketing...an implied customer acquisition cost (CAC) of $1,220.18 — but that marketing spend is nearly made up by the incremental profit ($1,161.40) on a bike or treadmill. That means that subscription profits are just that: profits.”

Peloton is expanding to new potential customers. Within this past month they launched apps on Roku and Apple TV.

Bear case

Oddly enough, bears are pessimistic on the same topics bulls love. Namely Peloton’s:

Market growth will stall

Moats are weak

Path to profitability is not certain

Market Growth

Bears reason Peloton’s growth will stunt once gyms reopen for good. Despite gyms being closed, a survey found that 70% of fitness enthusiasts miss going to the gym. Bears are hanging on to Dr. Fauci’s cautiously optimistic early 2021 COVID vaccine timing.

Moats

Bears think while a great brand is nice, it’s considered a ‘weak moat.’

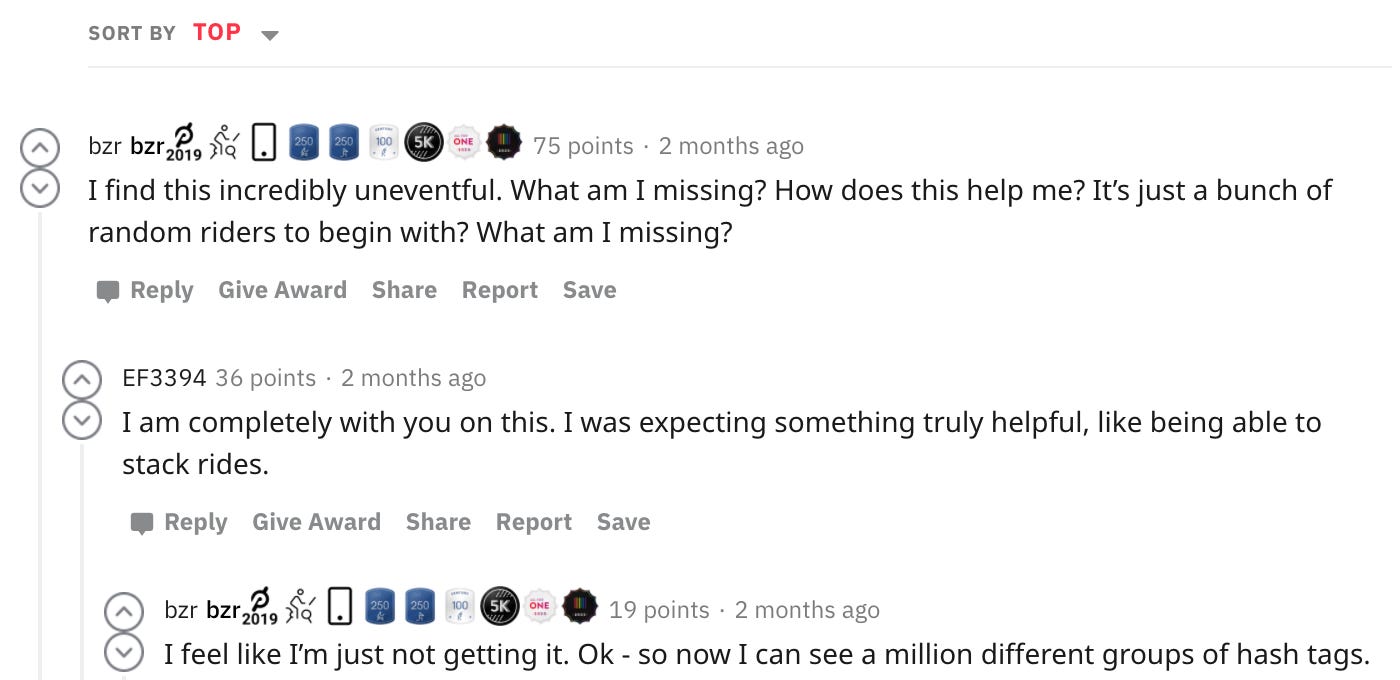

Concerningly, Peloton is fumbling on building a stronger moat. Peloton could build network effects through social features.

As Thompson writes again,

“[I] have been pretty disappointed in how underdeveloped the social aspects are. There is no way to easily track friends...or to start an arbitrary competition on an arbitrary date, or even to coordinate an in-demand ride. It’s honestly pretty pathetic...the company has been around for seven years now and it appears to me that very little progress has been made.”

To give the bulls a counterpoint: Peloton’s CEO addressed this in a March call. He said,

“We do have a couple of really sexy social features in the queue...it's a high priority for us because we know our members want it, and it's going to protect us and strengthen the moats for our business."

But I believe bears have the upper hand here. Peloton’s first released social feature since that call, ‘Tags’, left normally culty members of the Peloton subreddit unimpressed.

Path to profitability

Bears only see the path to profitability getting harder. For Peloton to grow, they need to keep spending more and more money on marketing. Customer acquisition costs (CAC) rose over 10% last year - from $1,097 in 2018 to $1,222 in 2019.

Rising CAC + eventual gym reopenings = Bears delight.

Your point of view

Are you a Peloton bull or bear? I’d love to hear your opinion!

To kickstart your thinking, here are some things to consider:

Can Peloton sell more subscriptions?

Is brand enough of a lock in?

Will CAC balloon like Blue Apron or stay manageable?

Reply to this with your stance and top of mind reasoning. If enough interest, we’ll do another post on what the Witty community is thinking.

Happy Friday,

Note: This content is for informational purposes only. It should not be relied upon as legal, business, investment, or tax advice. Your use of the information contained here is at your own risk.