👋🏽 Welcome to Witty Wealth’s The Daily Wit. We are a community that helps tech stock investors build confidence in their abilities. 1486 of us have our wits.

If you’re enjoying this, please share Witty with someone you talk stocks with.👇🏽

Worn out.

While we learned the Uber bull case earlier this week, many insiders and investors talked to are anything but. These folks were pessimistic, or at best mixed, on the future of the company.

I learned it comes down to one theme: it’ll be a constant fight for profitability.

While Uber is known for its ruthless past, the worry is their ecosystem is just as harsh.

Low margin short term

We discussed Uber’s Super App strategy before. While financial services aren’t part of the plan anymore, the rest of the plan seems still on the table. Here’s what Uber’s CEO mentioned at Thursday’s earnings call:

Uber aims to be the go to for ‘on-demand delivery.’ While that is exciting, insiders are concerned. Delivery in general is fraught with subsidies and intense competition. One former employee mentioned to me,

“11 years in and we still aren’t profitable. I doubt we’ll get to better than razor thin margins.”

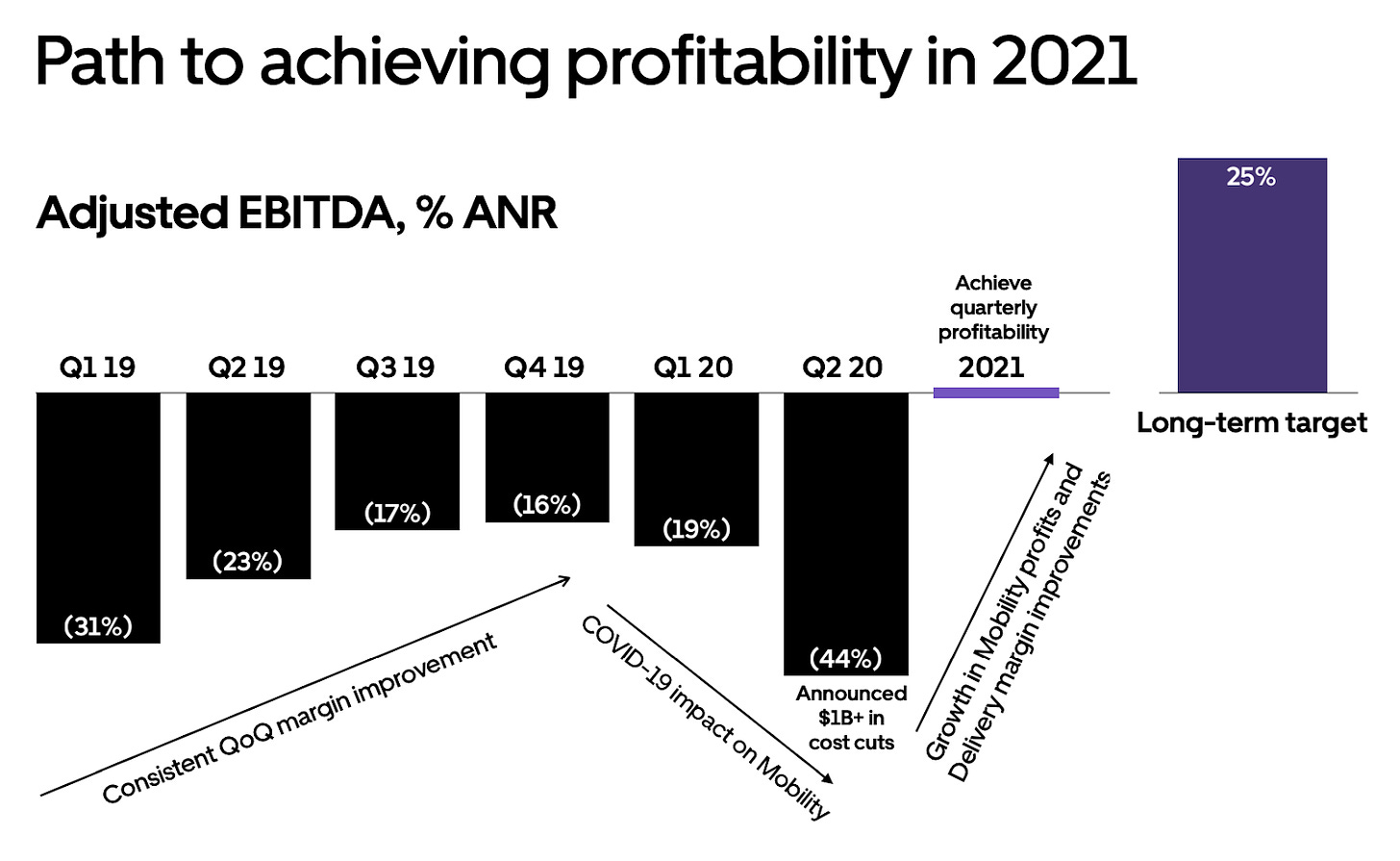

This chart from Thursday’s Q2 investor presentation did not inspire confidence in a different bear I talked to.

Uber can theoretically improve margins and defensibility with scale. Wall Street won’t support reinvestment in growth until Uber shows they can be profitable.

Amazon creepin’ long term

While Uber wants to be the Amazon for transportation, funny enough, it looks like Amazon and Uber will lock horns long term. The same things Uber offers - affordable and convenient delivery, and soon a variety in selection, is in the same game as Amazon. Here’s a relevant quote from Bezos,

“I very frequently get the question: "What's going to change in the next 10 years?" And that is a very interesting question; it's a very common one. I almost never get the question: "What's not going to change in the next 10 years?" And I submit to you that second question is actually the more important of the two -- because you can build a business strategy around the things that are stable in time...In our retail business, we know that customers want low prices, and I know that's going to be true 10 years from now. They want fast delivery; they want vast selection.

It's impossible to imagine a future 10 years from now where a customer comes up and says, "Jeff, I love Amazon; I just wish the prices were a little higher." "I love Amazon; I just wish you'd deliver a little more slowly." Impossible.

And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”

Amazon is setting up competitive infrastructure now. They dipped their toes in last month by acquiring self-driving startup Zoox for $1.2B. At the time, Amazon wrote,

“We’re acquiring Zoox to help bring their vision of autonomous ride-hailing to reality.”

They also have plays for food delivery, grocery, and on-demand. In food delivery, Amazon recently bought a 16% stake in multibillion dollar Deliveroo. For grocery delivery they offer Fresh. For on-demand, they offer Prime Now.

In this long term fight, Amazon is shaping to be Ivan Drago to Uber’s Rocky Balboa.

Vulnerable until profitable

Wrapping these two together, Uber is in a vulnerable position until they get profitable. The bull case is wrapped in a bundle. The investment required to get there is tied up until Uber gets space from Wall Street again.

In the meantime, competitors have the opportunity to pounce. Food delivery competitor DoorDash raised $400M at a $16B valuation a month ago. Amazon flexed their money cannons last week with little investor resistance. They are putting in a jaw dropping $10B in an unrelated field, to compete against SpaceX in satellite broadband.

Time to decide

The purpose of this experiment was to develop an opinion on Uber stock.

I have mine. What’s yours? Are you buying? Shorting? Waiting? Why? Let me know by replying to this email!

I’ll be back on at the end of the week with what I am doing and takes I hear from the Witty community.

Have a great week!

Anuj

Note: This content is for informational purposes only. It should not be relied upon as legal, business, investment, or tax advice. Your use of the information contained here is at your own risk. I am not a financial advisor.