👋🏽 Welcome to Witty Wealth’s The Daily Wit. We are a community that helps tech stock investors understand what’s going on. 1425 of us have our wits.

If you’re enjoying this, please share Witty with someone you think will enjoy us too.👇🏽

Opportunity was in the air.

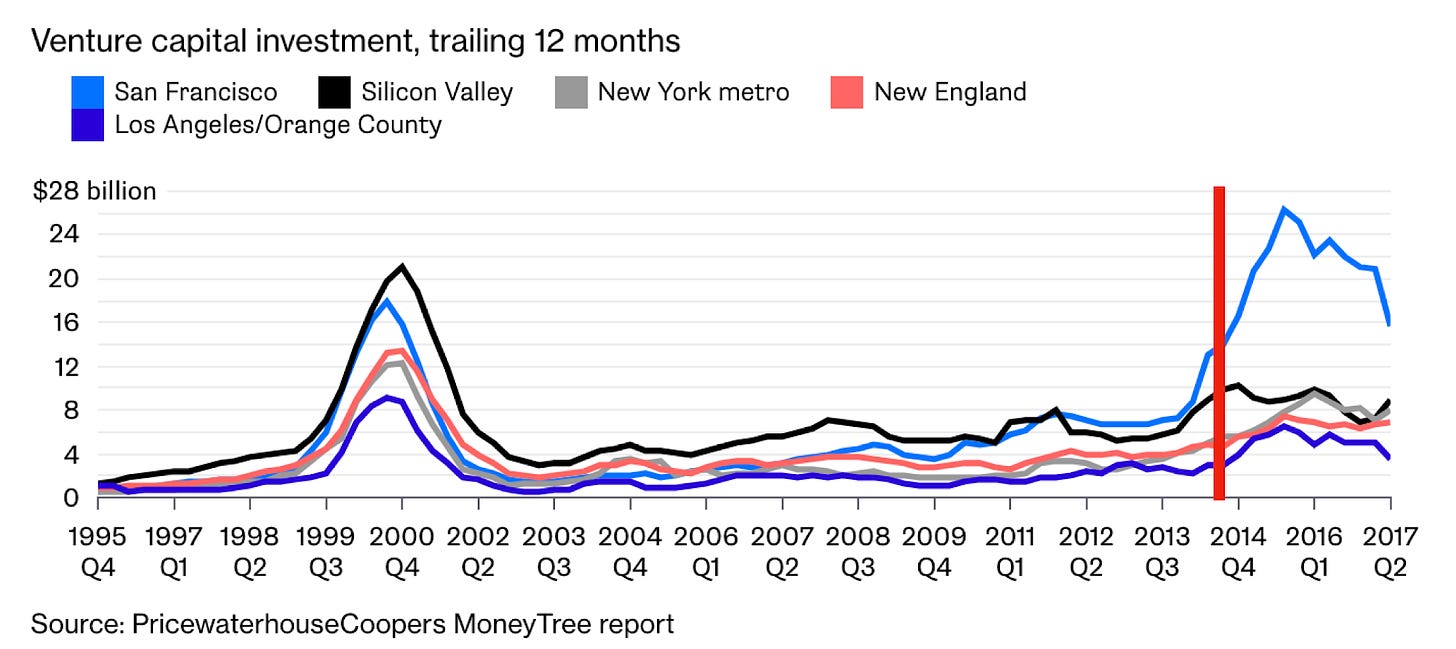

It was August 2014 in San Francisco. Anything (and I mean anything) you wanted to do could now simply be done via your smartphone. Venture capital investment was booming to dotcom levels.

A big pot was ridesharing. Taxis were so last year.

I was interning with a ridesharing leader, Sidecar. We were competing with Lyft and Uber for what was then popularized as a ‘winner take all market.’

When I started my summer, we were behind, yet had an optimism we could innovate our way to survival. When my 3 month internship ended, the writing was on the wall. We were left for dead.

Uber ruthlessly out executed us on anything and everything. I still shudder when I read this article. One of the projects I was on, shared rides (UberPool equivalent) was scooped by Uber the day before we were to launch. We had the finished product ready to go. They threw up a vague coming soon landing page.

The hard work. The hope. The opportunity. Poof.

Internally we felt just like the journalist who was about to break Trump’s Russian ties:

WTF Pick

6 years later, Uber’s desire to shake up transportation has not faded. Yet 1 year post IPO, the stock has begun to…

The company is at an interesting juncture. They are on an acquisition spree, yet it’s still unclear how they’ll make money.

As Matt Levine wrote this month about Uber,

“If you believe this model ... if you believe this model then capitalism is broken, 1 + 1 = 3, water flows uphill, aliens are real, you can be your own grandfather, anything is possible.” (!)

Another Witty member mentioned to me,

“I do not understand Uber and their long term strategy. Is there a new one post-Covid? Autonomous driving? An Expedia-like business of bundling transportation and lodging? Deliveries?”

On the surface, Uber has high potential. It can change the world even more. It’s also one that Witty members emailed about, wanting to learn more.

It makes the perfect petri dish for our first Witty Transparency Fund (WTF) experiment.

WTF to expect from me

I’m excited to kickoff WTF #1 today!

My goal with this series is for us to develop an opinion on Uber. I don’t have an opinion yet either. It’ll be fun to do so together.

Here’s what to expect from me. For the next ~2 weeks, each day (Monday - Thursday) I’ll bring a new dimension about Uber. That means primers on the company, bull / bear cases, and expert interviews.

I’m fortunate to know many folks (and Witty members!) who have knowledge on the company. From investors, employees, and competitors, to on the ground workers like drivers. I believe we’ll get a comprehensive view!

Finally, once we get towards the end of the series, we’ll figure out a way for a group debate and to decide investment.

What I need from you

If you want to play along, here are 2 simple things you can do that’ll make this even more fun.

First - what questions do you have about Uber? These are things I’ll explore and try to bring up in posts and interviews. Feel free to reply to this email.

Second - please share this post with any person or group you talk stocks with. I believe investing is more fun as a multiplayer game. Growing the Witty community will add to that.

I’ll be back tomorrow with a primer on Uber!

Happy Monday,

Note: This content is for informational purposes only. It should not be relied upon as legal, business, investment, or tax advice. Your use of the information contained here is at your own risk.