👋🏽 Welcome to Witty Wealth’s The Daily Wit. We are a community that helps tech stock investors build confidence in their abilities. 1456 of us have our wits.

If you’re enjoying this, please share Witty with someone you talk stocks with.👇🏽

Surprised.

After posting yesterday’s piece on Uber’s Super App dream, I learned it may stay that way - a dream. A Witty member sent this from a month old Bloomberg article:

“In an email to staff on Thursday, Uber Chief Executive Officer Dara Khosrowshahi said that Uber will “deprioritize” several of its finance-related projects, which have included credit cards, a digital wallet and instant payments for drivers.”

My first reaction - whoa! This is pretty big. How’d I miss it? Introduced less than a year ago, Uber Money was a potential game changing bet. Now it’s folding?!

When I looked afterwards, I found I wasn’t the only one who missed it. Searching the web, I couldn’t find any discussion. In fact, this was the only tweet with more than 5 likes.

My second reaction - pumped! Our thinking from yesterday was in the right place.

In the piece, I was bearish that Uber could pull off the financial services play.

“The banking narrative paints a rosy future for the money losing Uber.

While the concept is powerful in theory, I question, can Uber reach the same depth as Gojek? My initial gut reaction is pessimistic...

In the US and Canada, Uber’s home market, using the Gojek ‘10x’ approach looks unlikely. Credit card penetration is already at ~70% and ~90% respectively.”

Uber hasn’t said anything publicly about their strategy since that Bloomberg article. Ever curious, I wanted to know what was going on.

Fortunately for us, we have the Witty community. I talked to 3 members who are intimately knowledgeable about Uber. Here’s what I learned.

Solution in search of a problem

As an investor, Uber’s financial services play was like Kevin’s Chili. Great in theory. Tricky in reality.

From yesterday,

“Banking and payments offers Uber an opportunity to both make more revenue and profit. Moving digital items (money) is less costly and more replicable than moving physical items.”

Uber Money had potential in Africa and South America, and that’s about it. That’s not big enough to make it a core company focus.

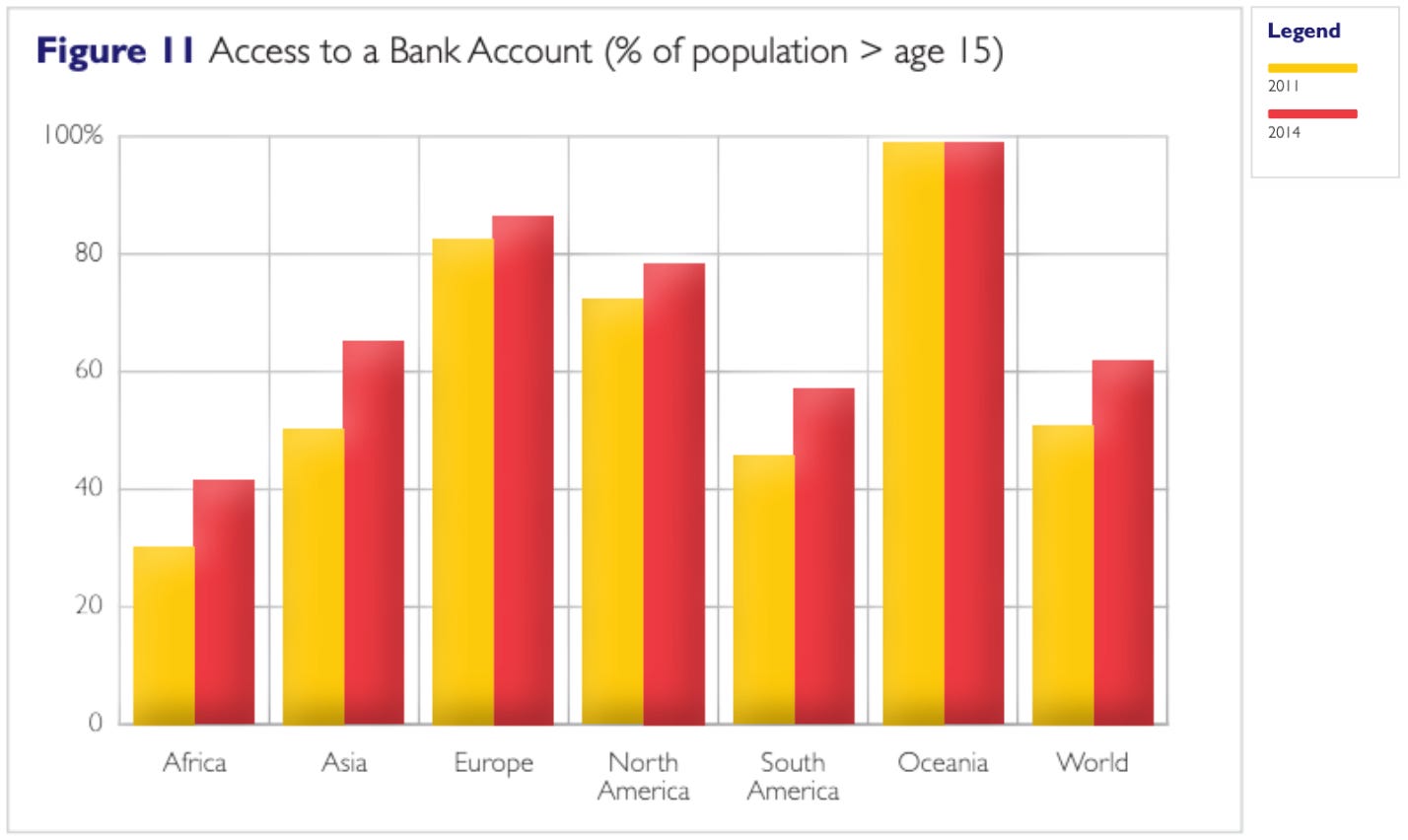

Here’s how I crudely think about the opportunity. We can proxy it using this chart from the 2018 World Cash Report.

For Uber Money to succeed in a geography, it needs to be a 10x better solution than what else is out there. The clearest 10x solution is providing these services to someone without a bank account.

Off the bat, Europe and North America have limited opportunity. ~80%+ bank account rates.

Asia, Africa, and South America have a potential fit. Sadly for Uber Money, Uber exited Southeast Asia through various sales and mergers from 2016-2018.

That leaves Africa and South America. Again, not big enough to make it a core company focus.

Profitability War Path

There’s a clear motive behind this deprioritization: short term profitability. Pre-COVID, Uber issued guidance they’d be profitable by the end of 2020. Those goals are now set for 2021.

“Our goal remains the same, returning our growth to business and achieving profitability for all of our stakeholders, which we are now planning to achieve on an adjusted basis, on a quarterly basis, in 2021.” - Nelson Chai, Uber CFO

I’ve spent time in the boardrooms of growing tech companies. When a short term, measurable milestone is the mandate, decisions are made as described in this Lil’ Wayne lyric:

It’s a major move right here baby

You gotta get with it, or get lost, you understand?

The Witty members I talked to said Uber Money wasn’t going to move the needle in that time frame. Time for it to get lost.

Shot, chaser

Uber’s financial services play looks shelved indefinitely. The Head of Uber Money, Peter Hazlehurst, is leaving the company due to this change. This quote from Bloomberg is telling,

Uber Technologies Inc.’s financial services leader Peter Hazlehurst is calling it quits as the ride-hailing giant focuses on rides and food delivery, and ices plans to become a financial services company...

Hazlehurst announced his decision Thursday in an email to his Uber Money team...In an interview, he added, “If we aren’t going crazy big on these products then I should get out of the way.” Hazlehurst said the New York-based team Uber hired to build financial services is now working on projects for Uber Eats.

What’s next?

The purpose of this WTF is to develop an opinion on Uber. Now the financial services bet is dead, what’s next? Two things. First, I think we’ll find some ideas by looking at Uber’s path to profitability.

Second, I’m riffing with friend-of-Witty, the fintwit renowned Turner Novak on Friday. He has money behind Uber. I plan to ask why he is bullish.

If you have any questions for Turner, feel free to reply to this email!

See you tomorrow,

Note: This content is for informational purposes only. It should not be relied upon as legal, business, investment, or tax advice. Your use of the information contained here is at your own risk. I am not a financial advisor.