👋🏽 Welcome to Witty Wealth’s The Daily Wit. We are a community that helps tech stock investors build confidence in their abilities. 1463 of us have our wits.

If you’re enjoying this, please share Witty with someone you talk stocks with.👇🏽

Death by a thousand optimizations.

In 2014/2015 I had a food delivery startup, Mealjet. This industry isn’t for the faint of heart. It’s rife with low margins and opportunities to die.

Every day is a grind. Our approach to surviving was experimenting with every facet of the business. Three of my favorites included:

Wholesale buying to reduce our food costs

Memes to lower our customer acquisition costs

Volunteer labor from fellow college students to have zero development cost

In this pandemic, Uber Eats is more valuable than ever to Uber. Uber also has a mandate to be profitable by the end of 2021.

“Our goal remains the same, returning our growth to business and achieving profitability for all of our stakeholders, which we are now planning to achieve on an adjusted basis, on a quarterly basis, in 2021.” - Nelson Chai, Uber CFO

Given my Mealjet burns, I wonder, can Uber get to profitability?

After diving into it, I believe they can. At the end of 2021, I hope to look at the Uber team like this.

Why? Let’s dig into Uber’s two core business units: Rides and Eats.

Rides

When I read Uber’s most recent earnings results, I was surprised. The Rides business is doing better than I thought! In fact, you could consider it a standalone profitable business before COVID.

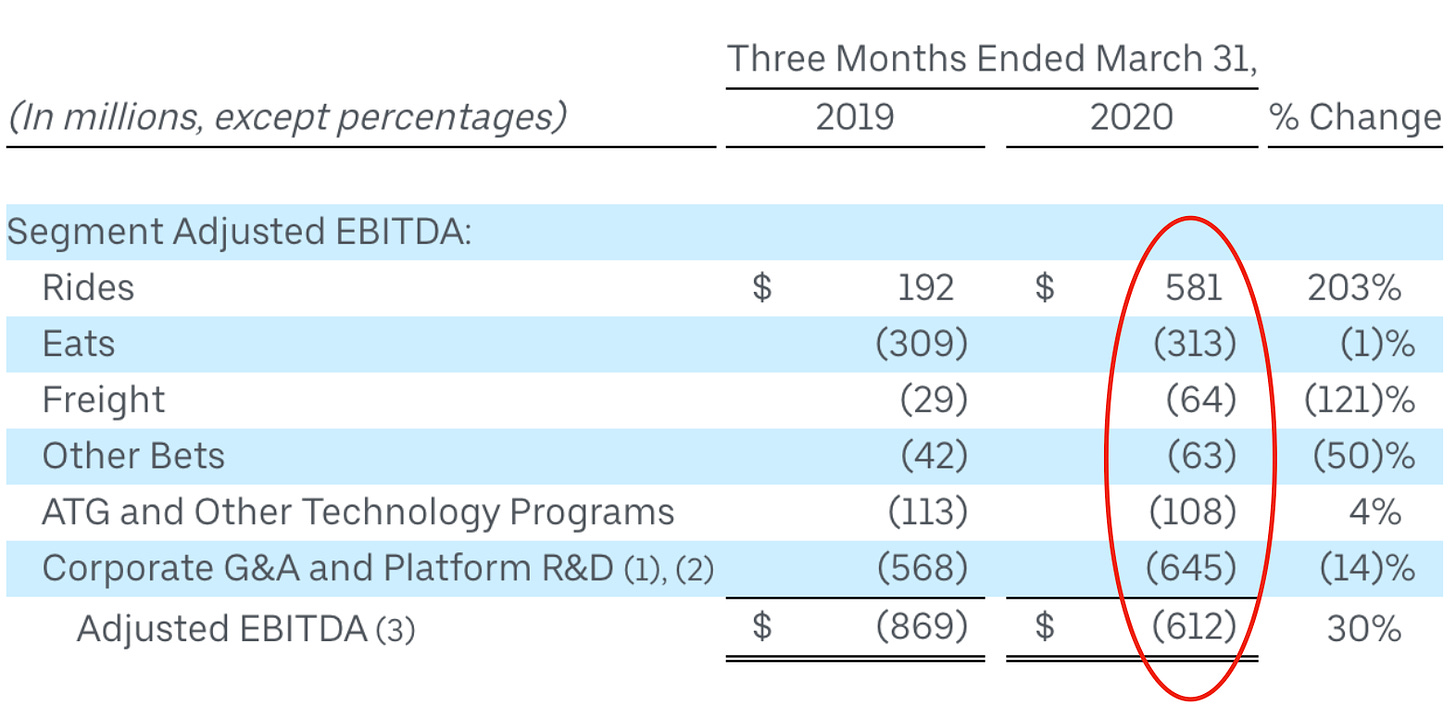

Rides had $581M in ‘adjusted’ earnings in Q1 2020. That doesn’t include subtracting its part of the shared resources, ‘Corporate G&A and Platform R&D’ (see image below). That said even if you assumed Rides used 90% of those resources, Rides would be profitable.

Note: ‘Adjusted’ earnings is a creative accounting term that is turning into a meme. In Uber’s case, it’s the EBIDTA minus this microscopic litany of business building scaffolding.

Now, how will Rides fare with COVID? I believe Rides will return to profitability eventually. In areas that are back up and running, like Hong Kong, the rides business has recovered 80+% from its coronavirus lows. Additionally, Uber has $10B in unrestricted cash on hand to figure it out again.

Eats

Through March 2020, Uber Eats had a long way to go to become profitable. Even with creative accounting, they were $313M in the hole in Q1.

Can Eats get to viability? Let’s go back to the basics and use Profit = Revenue - Costs.

How’s revenue looking?

Eats is popping off in this pandemic! We don’t have hard numbers yet, but these two points are telling.

“Our delivery business is growing at rates that, frankly, I didn't think was possible…” - Dara Khosrowshahi, Uber CEO

To get an anecdote of how intensely people rely on Uber Eats, check out this Russell Crowe interview on Jimmy Fallon. Crowe’s kids isolated in Sydney instead of joining him in the Australian Bush. Why? They wanted access to Uber Eats!

What about costs?

It’s the Hunger Games at Uber HQ.

In Q4 2019, Uber unveiled an aggressive, binary strategy for Eats: lead the market or leave the market. Specifically, the company must be one of the top two delivery providers in each market it operates in, or exit. They are chasing profitability through economies of scale.

This is beginning to play out. Uber Eats sold its struggling India business to Zomato. They also bought Postmates earlier this month to solidify its position in the US. From Bloomberg,

For Uber, the purchase comes at a reasonable price and could help lead to a rational—and perhaps someday, profitable—market, said Benjamin Black, an analyst at Evercore ISI. “You had four players who were very aggressive on price and were essentially giving away food for free,” said Black. “Rational pricing will start to kick in after consolidation.”

Once Eats get to that position, they aim to flex their power further to improve profits.

“And once we get to that number one or number two position, we think the power of the platform, the Uber brand, our ability for the Rides business and the Eats business to work together to acquire customers and to retain customers will just be advantaged over the other competitors out there." - Dara Khosrowshahi, Uber CEO

While it requires a leap of faith, it makes sense to me.

What’s next

The purpose of this WTF is to develop an opinion on Uber. Now we have an idea on profitability, what’s next? The main outstanding questions revolve around Uber’s future. Namely:

What is Uber’s moat?

What captivating products could Uber launch?

If we like the stock, at what price should we target?

We’ll get into these next week. In the meantime, if you have thoughts on any of these, I’d love to hear from you! Feel free to respond to this email.

Have a great weekend,

Note: This content is for informational purposes only. It should not be relied upon as legal, business, investment, or tax advice. Your use of the information contained here is at your own risk. I am not a financial advisor.